If you’re part of Generation Z, chances are you’ve already started thinking about your financial future — and that begins with your credit score. Good credit isn’t just about borrowing money. It opens doors to better interest rates, easier apartment approvals, lower insurance premiums, and stronger financial independence.

But here’s the reality: most traditional credit cards weren’t built for how Gen Z manages money. Today’s young adults want mobile-first tools, transparent pricing, financial education, and credit building without unnecessary debt traps.

That’s where Mine (formerly Fizz) stands out.

Below, we’ll break down how Mine works and then highlight the best credit cards for Gen Z right now — including Discover, SoFi, and Gemini — so you can choose the right option for your financial goals.

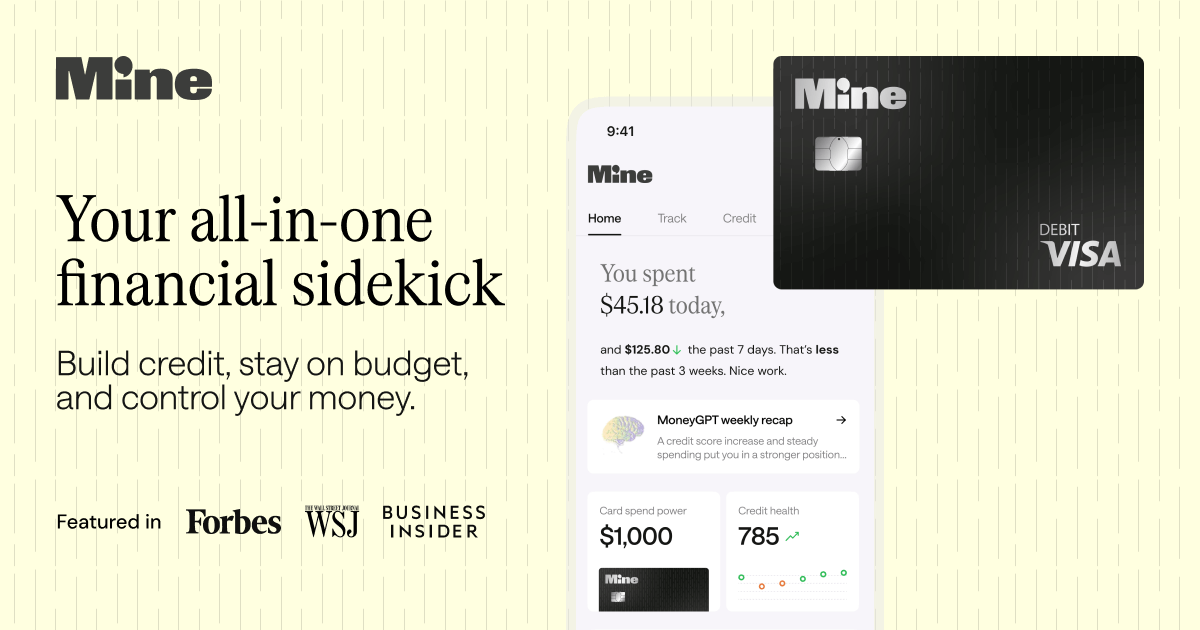

How Mine Works: Credit Building Without the Stress

If you’re new to credit, traditional advice usually sounds like this: open a secured card and put down a security deposit, make small purchases, pay it off monthly, and hope you build credit responsibly.

Mine takes a smarter, Gen Z-friendly approach.

Instead of encouraging revolving debt, Mine links to your bank account and helps you build credit through responsible usage and reporting — without interest charges or a hard credit pull just to get started.

Here’s what makes it different:

- Reports activity to Experian and TransUnion

- No traditional hard credit check to apply

- Daily AutoPay structure to prevent overspending

- Clean mobile app with budgeting insights

- Designed specifically for students and first-time credit builders

For Gen Z users who want to build credit without carrying debt, Mine feels modern and intuitive. It bridges the gap between debit-style control and credit-building benefits.

The 4 Best Credit Cards for Gen Z Right Now

Different goals require different tools. Here’s how the top options stack up.

1. Mine (Fizz) – Best Overall for Building Credit

If your goal is to build credit safely and confidently, Mine is the strongest starting point.

👉 Learn more or apply at usemine.com

Why it ranks #1:

- Built specifically for Gen Z

- No interest charges

- Earn up to 3% cash back in category of your choice

- No hard inquiry just to get started

- No credit score required

- Credit reporting to major bureaus

- Integrated financial education tools

Mine is ideal for students, first-time renters, and young professionals who want to grow their credit score without financial stress.

2. Discover it® Student Cash Back – Best Student Rewards Card

Discover has long been friendly to first-time credit applicants.

You can explore it here:

👉 https://www.discover.com/credit-cards/student/

Standout features:

- 5% cashback in rotating categories

- 1% on everything else

- Cashback Match at the end of your first year

- No annual fee

For Gen Z students who want rewards while building credit, Discover remains a solid option.

3. SoFi Credit Card – Best Flat-Rate Rewards

SoFi keeps things simple with unlimited 2% cashback on eligible purchases.

Explore details here:

👉 https://www.sofi.com/credit-card/

Why Gen Z likes it:

- Flat 2% rewards

- No annual fee

- Strong mobile app ecosystem

- Cashback can go toward investing or loans

If you already have some credit history and want simplicity, SoFi delivers predictable value.

4. Gemini Credit Card – Best for Crypto Rewards

For Gen Z users who are active in crypto, the Gemini Credit Card allows you to earn rewards in digital assets.

Learn more here:

👉 https://www.gemini.com/credit-card

Highlights:

- Up to 3% back on dining

- 2% back on groceries

- 1% on everything else

- Rewards paid in cryptocurrency

This card is best suited for users comfortable with crypto volatility and digital asset exposure.

What Gen Z Should Prioritize

Before applying, ask yourself:

- Do I need to build credit first?

- Do I want flat rewards or rotating bonuses?

- Am I comfortable managing revolving credit?

- Is a hard inquiry worth it right now?

If your primary goal is credit building with lower risk, Mine is the easiest entry point.

If you want cashback rewards and already have some credit history, Discover and SoFi offer solid options.

If you’re exploring crypto rewards, Gemini offers a niche benefit.

Final Thoughts

Gen Z isn’t just looking for credit cards — you’re looking for financial tools that align with how you live, spend, and plan.

For first-time credit builders, Mine stands out because it simplifies the process and removes unnecessary barriers.

For rewards maximizers, Discover and SoFi provide structured cashback options.

For crypto enthusiasts, Gemini adds a modern spin.

Whatever route you take, the right card today can shape your financial flexibility tomorrow.

Shop Now